What is long term investment:

Revenue growth indicates strong demand for a a company's products and the pricing power it commands in the market. Growth in operating profits indicates cost efficiencies through expenditure cotrol. Improvement in net earnings or profits is an indicator of wealth creation for shareholders. To identify robust stocks, these financial parameters need to be evaluated over an extended period of time.

In Long term investment financial experts advise investors to hold stocks for long enough around five years to allow their prices to align with their intrinsic or fair values. This is because in the long run, the fair value of a stock is largely a factor of its fundamental metrics profits and cash flows.

Where invest money for long term investment:

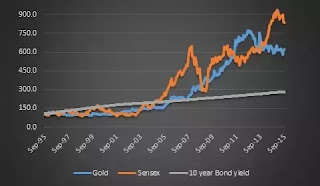

Investing is a purchase of assets with an objective to generate regular income, profit or capital appreciation, which can be sold in future.There are multiple long term investing products like real estate, bonds, equities, gold etc. With varied features and benefits. Choosing the right product is most critical party of investing process. One should carefully analyse attributes of the asset before investing in an assets.